Incentives

Most states or utilities have significant rebates available to homeowners for energy efficiency upgrades including heat pumps, heat pump water heaters, weatherization, and Rooftop Solar. Some states are able to offer federal rebates for income qualified homeowners and renters for efficiency upgrades. Because these incentives can be confusing and hard to identify, we have assembled the below resources for Oregon, Washington and California to help you find what is available to you.

Incentive Resources and Fact Sheets

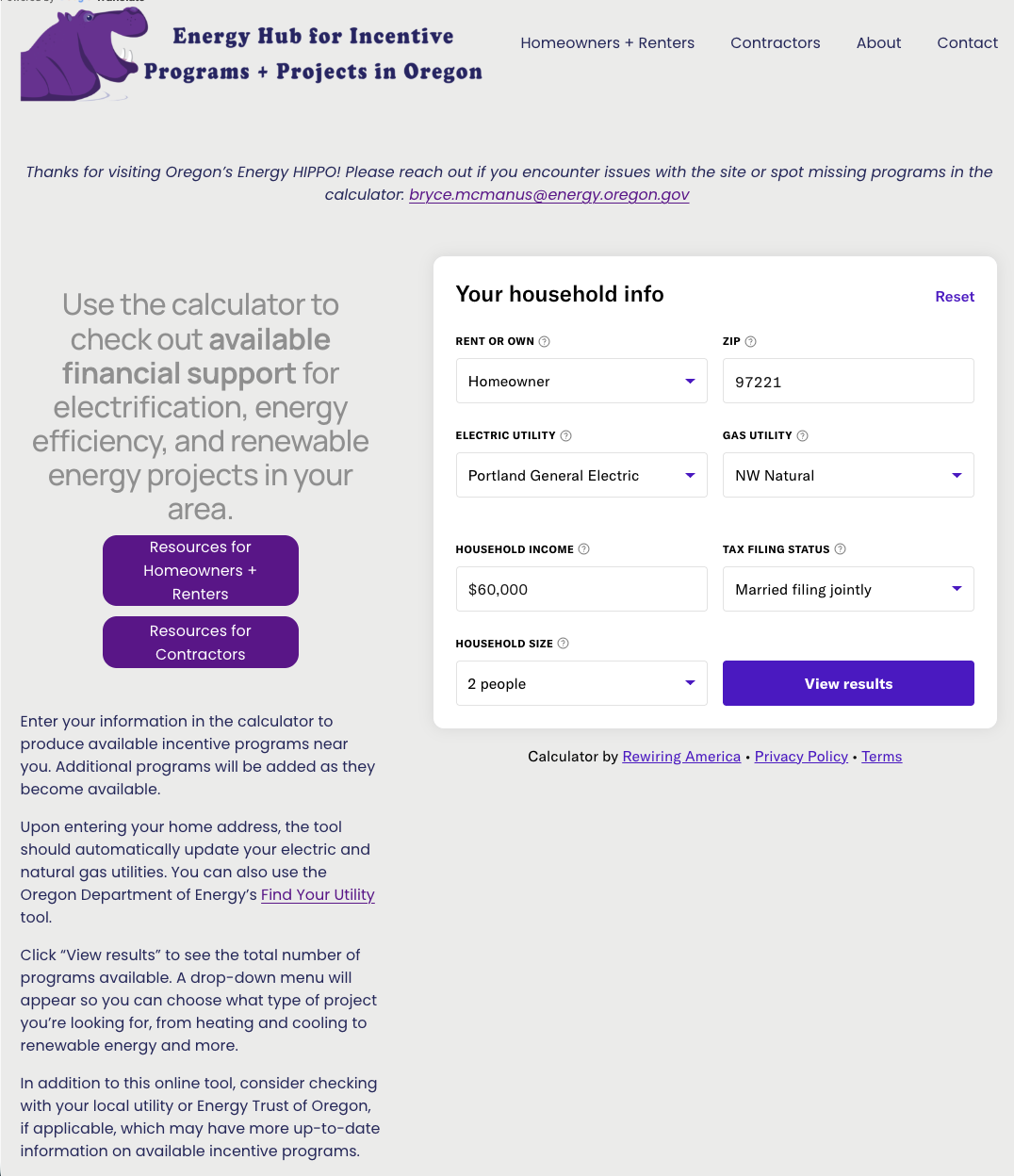

Find energy efficiency incentives in Oregon

The Hub for Incentive Programs in Oregon, HIPO, has a detailed list of all available energy efficiency upgrade incentives. Insert your zip code and household income to get a tailored list of incentives you qualify for.

Energy Trust of Oregon Incentives

If you get electric or gas services from PGE, Pacific Power, NW Natural, Cascade Natural Gas or Avista, you could qualify for incentives for heat pumps, heat pump water heaters, weatherization and more. Check out this information sheet which lists all the available incentives and the requirements to receive them.

Find energy efficiency incentives in California

The Switch Is On is a great resource for electrification in California with information on contractors and an incentive finder tool to help reduce the costs of making your home safer and more energy efficient.

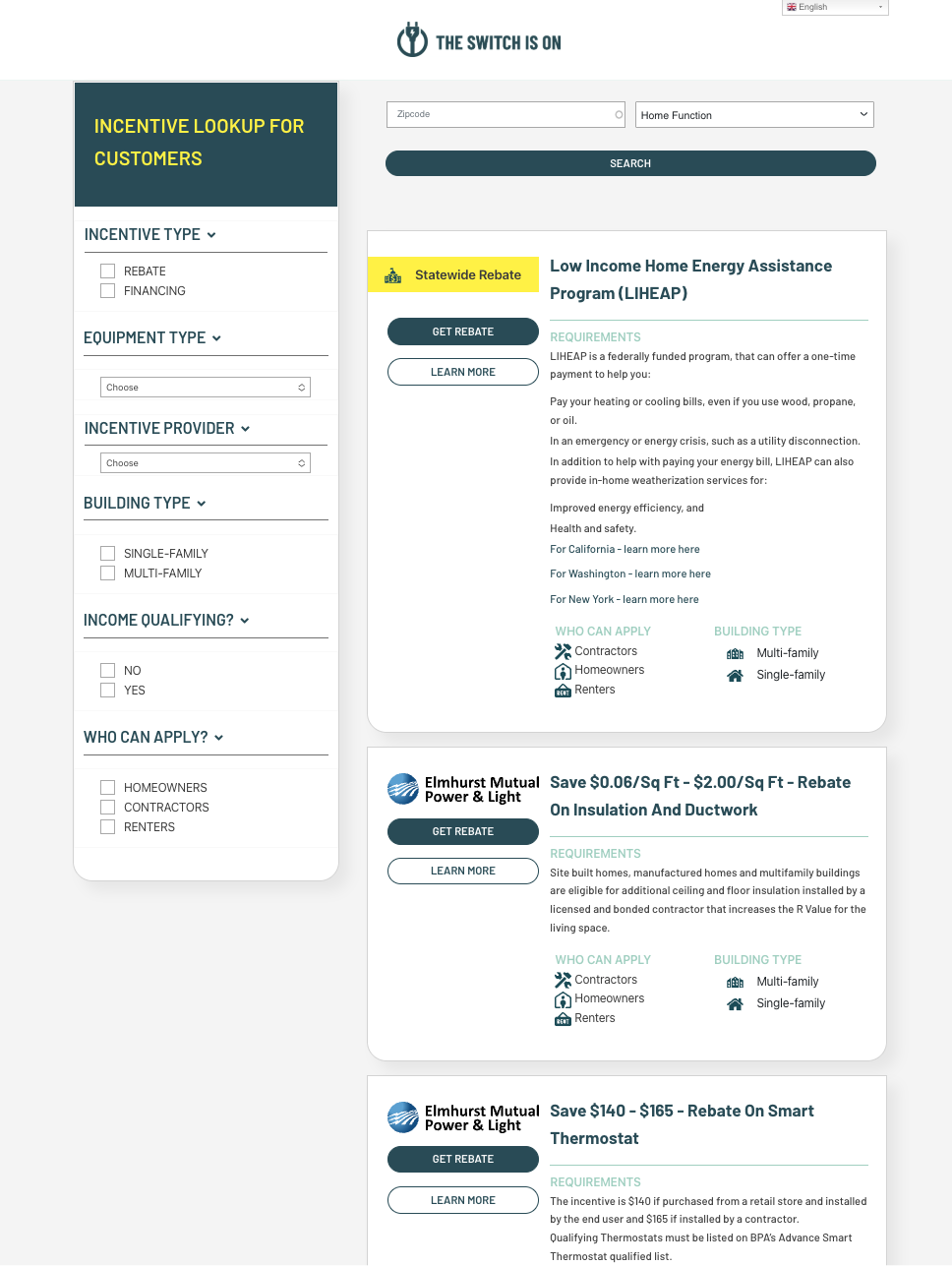

Find incentives in Washington State

The Switch is on also provides an incentive finder for Washington to help you locate state and utility based incentives available to you.